- Our School

- Our Advantage

- Admission

- Elementary•Middle School

- High School

- Summer

- Giving

- Parent Resources

- For Educators

- Alumni

Planned Giving

Investing in Landmark School with a Planned Gift

We invite our alumni, families, and friends to consider planned giving as a way to maximize their philanthropic potential and create a legacy at Landmark School. Though different in detail, each of our planned giving options will provide you with substantial benefits which may include:

- Reduced Income Tax

- Avoidance of Capital Gains Tax

- Reduced Estate Taxes

- Membership in Landmark’s Charles P. Harris Planned Giving Society

Planned Giving Options

Please note that Landmark does not offer custodial services and recommends that donors seek their own.

Bequests

The simplest way to include Landmark in an estate plan is to make a bequest to the school through a will. Landmark School highly encourages donors to provide a Documented bequest intention, where an amount of money is specified as part of the donor’s will to be given to Landmark School. At the time that the bequest intention is shared with Landmark School, these gifts will be recorded with Landmark’s business office and creditable for donor recognition based on the age of the donor. If the donor is 65 years or older at the time of the bequest intention, the gift will be credited for donor recognition at the full value of the commitment. If the donor is 64 years or younger, the intention will be counted at the actuarial value. Undocumented bequest intentions, where the donor informs the School that they intend to include Landmark School in their will, but do not specific an amount or provide documentation, will become members of Landmark’s Charles P. Harris Planned Giving Society, but gifts are not recorded by Landmark's business office or credited with donor recognition until they are realized distributions to the school.

Complete a Bequest Intention form today and have your planned gifts count as part of this fiscal year!

Individual Retirement Plan Assets

Gifts of qualified Individual Retirement Accounts (IRAs) may be accepted by Landmark School. A donor may structure gifts of such assets either through an outright transfer to Landmark School by means of a beneficiary designation or through a charitable remainder trust designated to provide life payments to one or more beneficiaries of the donor’s estate.

Gifts of Life Insurance

Landmark School may accept paid-up life insurance policies and the value for donor recognition crediting purposes may be the policy’s replacement cost. If the policy is partially paid up, the value for donor recognition crediting and accounting purposes is the policy’s cash surrender value. Landmark School can be named a contingent beneficiary or the beneficiary of a percentage of a life insurance policy. Landmark School will not accept gifts from donors for the purpose of establishing insurance on the donor’s life.

Life Income Arrangements

With questions about any life income arrangement, please contact the Office of Institutional Advancement. (Example: annuities and charitable trusts.)

For more information about Planned Giving at Landmark School please contact Michelle Granese, Director of Institutional Advancement, [email protected]

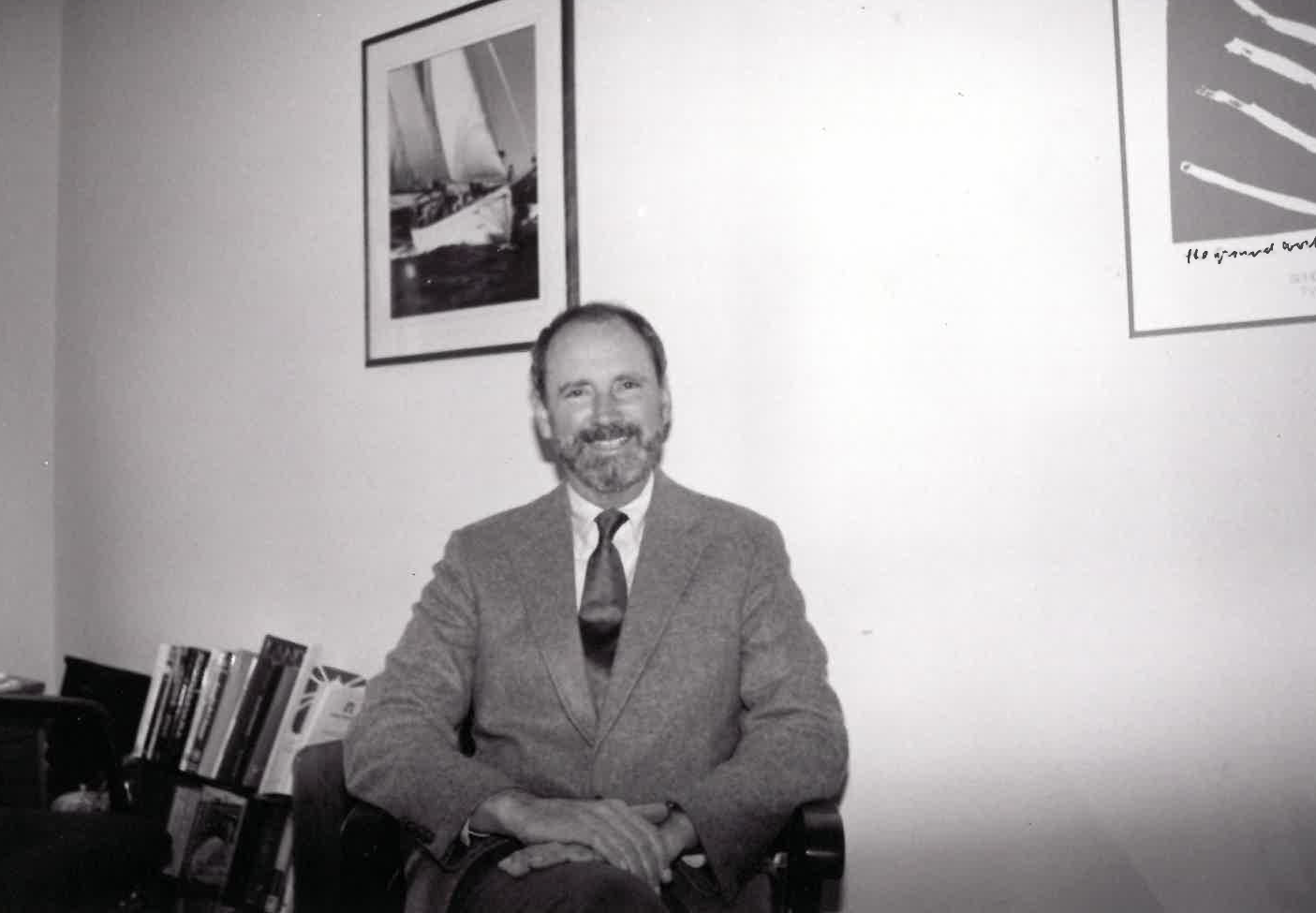

The Charles P. Harris Planned Giving Society

Charles “Charley” Harris (1930 - 2020) was an integral part of the Landmark School community from the School’s founding in 1971 - until his passing in 2020. As Landmark’s first Assistant Headmaster, and a founding member of Landmark’s Board of Trustees, Charley helped set the course for the school, and remained a steadfast guardian of its mission. Over the years, Charley held numerous roles at Landmark as fundraiser, financial aid counselor, liaison to the regulatory and accreditation agencies, and Director of Personnel. His wisdom, gentleness, integrity, and strong advocacy for children were a source of sustenance for Landmark for over five decades.